City leaders move forward council tax rise and spending plans for Sunderland

and live on Freeview channel 276

It includes a 3% precept to help fund the demand and cost pressures of adult social care and a 1.99% increase in core council tax.

Advertisement

Hide AdAdvertisement

Hide AdFinal decisions on the 2021/22 budget, including council tax, will be made at the annual budget meeting next month.

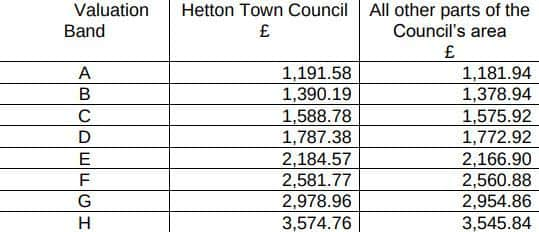

If approved, the council tax rise would see a Band A household, into which the majority of households in Sunderland fall, pay less than £1 a week extra towards city services.

Further precepts for police and the region’s fire authority are set to be added to the final council tax bill for both city and parish areas.

As part of the budget proposals, the council is also extending its Local Council Tax Support scheme, which will see eligible households get up to £150 off their bills.

Advertisement

Hide AdAdvertisement

Hide AdCurrent estimates are that around 16,500 working age claimants will pay no council tax in relation to next year.

Councillor Paul Stewart, deputy leader of the council, outlined the council tax proposals at Tuesday’s cabinet meeting.

“The council has done its best to protect residents from the impact of cuts since 2010,” he said.

“The compound impact of the Government’s significant and disproportionate funding reductions in previous years, combined with unavoidable unfunded cost pressures, means we are once again faced with very difficult decisions.

Advertisement

Hide AdAdvertisement

Hide Ad“Raising council tax is one of those difficult decisions. We do not raise council tax because we want to.

“We need to raise council tax to ensure that we can minimise cuts in services and help support those communities and those individuals most in need.

“Indeed, in its financial settlement, the Government assumes that all councils will raise council tax by the maximum permitted level – in our case 4.99%.

“You will hear the Government say that they are increasing funding for local government – unfortunately nationally over 87% of the increase is to be raised through local council tax.

Advertisement

Hide AdAdvertisement

Hide Ad“In Sunderland, due to our relatively low council tax base, this proportion is lower but is still a significant 59% of the increase that the Government assumes will be available to the city of Sunderland and is being met by its residents.”

Cllr Stewart added the 4.99% council tax rise would represent an increase of 94p per week for a Band A property and despite the proposed increase, the council’s Band D council tax would “still remain the lowest in the region.”

Demand for adult social care continues to grow and the 3% council tax precept is expected to raise around £3 million.

For 2020/21 the adult social care budget was £157 million and it is the biggest part of the council’s day to day spending.

Advertisement

Hide AdAdvertisement

Hide AdCouncillor Graeme Miller, leader of the council, called for funding changes to prevent the Government “passporting the cost of dealing with adult social care” onto residents.

Deputy leader, Cllr Stewart, added that the council, which has had its spending powers reduced by a third since 2010, would continue to lobby the Government for a “true fair funding agreement.”

He said: “The future outlook remains very uncertain.

“There are continued unfunded cost pressures, combined with the ongoing uncertainty with regards to the Covid-19 pandemic as well as significant uncertainty around the impact of the Government’s spending review, fair funding review and the move to the 75% retained business rates, all of which are scheduled for the medium term.

“Based on the best information we have at this time, and after taking into account proposed savings plans and assumed future council tax increases, there remains a budget gap of around £35.7 million for the three years 2022/23 through to 2024/25.

Advertisement

Hide AdAdvertisement

Hide Ad“Work will, of course, continue to identify a further suite of proposals to address the remaining budget gap in future years and we continue to lobby the Government for a true fair funding agreement for local government that we desperately need.”

The council’s proposed revenue budget for 2021/22 includes savings of around £6.3 million.

Council bosses have said the savings aim to minimise further impact on front-line services with around £2.3 million of reserves also sidelined to help balance the budget and “limit cuts required in the following year.”

Revenue budget commitments include ongoing funding for environmental and housing services and extra support for young people who are not in education, employment or training.

Advertisement

Hide AdAdvertisement

Hide AdA 50% reduction in pest control charges for those in receipt of council tax support is also proposed, alongside a £1 million “response fund” to help communities recover from the coronavirus pandemic.

Meanwhile, a major capital investment programme to bring in new homes, improve infrastructure, and promote economic growth is also part of the budget and the ongoing City Plan for a ‘dynamic, healthy and vibrant Sunderland.’

The final budget will be discussed at a virtual meeting on Wednesday, March 3, which will be live streamed on Sunderland City Council’s YouTube channel.