Sunderland City Council left chasing almost £14million in unpaid Council Tax

Figures obtained in response to a Freedom of Information request by the Echo show the council took 48,883 accounts to court for non-payment over the last three financial years, in a bid to recover a total of £17,926,564.66.

At the end of the 2015/16 financial year, the outstanding balance was £13.89million. That compared with £12.86million at the end of 2013/14 and £12.49million in 2014/15.

Advertisement

Hide AdAdvertisement

Hide Ad

A senior opposition councillor and the Taxpayers’ Alliance pressure group said councils should make collecting unpaid tax a priority.

However, a leading council chief said the authority had continued to receive outstanding payments and that arrears now stood at £9.7million.

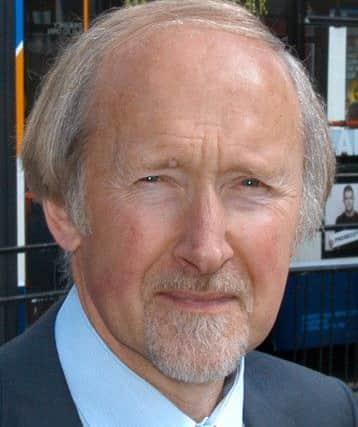

Opposition group leader Coun Peter Wood said: “Non-payment of Council Tax is a serious matter and the council should do all it can to chase-up arrears.

“Whether it be £17 926,564 or £12.86 or £13.8million, this is a lot of money which could have been spent providing essential services - or used to reduce Council Tax levels.

Advertisement

Hide AdAdvertisement

Hide Ad

“How much cleaner could our streets have been; how much smoother street surfaces or how much more social care for the elderly could have been provided if all the Council Tax due was paid?

“I trust the Council is doing all in its power to ensure Council tax revenues are maximised.”

John O’Connell, chief executive of the Taxpayers’ Alliance said it was important to ensure anyone who could afford to pay did so.

He added: “When councils should be tightening their belts, they really need to make sure they are collecting money they are owed,” he said.

Advertisement

Hide AdAdvertisement

Hide Ad

“Of course, there will be those who struggle to make ends meet but councils have to differentiate between taxpayers who can’t afford to pay their bills and those who refuse.

“Council chiefs could make it easier for those struggling by keeping taxes low but also learn the lesson from any mistakes in collection because it’s not fair on ordinary, law-abiding taxpayers for others to get away without paying their share.”

Council cabinet secretary Coun Mel Speding defended the authority’s record and said the outstanding debt had been significantly reduced since the start of the current financial year on April 1.

“More than 99 per cent of all council tax is collected in the long-term and residents have an excellent record of paying, with more than 65 per cent of householders signed up to a direct debit,” he said.

Advertisement

Hide AdAdvertisement

Hide Ad

“However, not everyone pays on time, as some continue to pay after the end of the financial year and the council continues to receive payments in respect of previous years’ council tax arrears, which are now £9.7million.

“The council also offers weekly payment plans and works closely with organisations such as Citizens Advice and Step Change who offer advice to those residents struggling to pay.

“The council will always aim for a fair and equitable approach in collecting any outstanding charges.”

Of the 48,883 accounts taken to court, the number of people within each account can vary as they cover multiple occupancy, single occupancy or empty properties.